You Need Crypto Experts to Solve Your IRS Tax Problems

Relax, we’ll deal with the IRS on your behalf and reconcile your crypto to present you with your options in the face of IRS scrutiny.

DO YOU OWE THE IRS $50,000 OR MORE?

Don't Waste Time

Enter your email to get started with our interactive consultation

Our CPAs, EAs and Crypto Accountants are trained and certified to represent you before the IRS, settling your tax issues and restoring your peace of mind

Tackling Your Crypto Tax Trouble

Our simple process consists of only four steps

STEP 1: CONSULT

Speak to a CPA (not a salesperson) about your letters from the IRS

A CPA can provide professional guidance and represent your interests, ensuring that you understand your options and responsibilities while also responding to IRS communications.

STEP 2: DIAGNOSTIC

We determine whether or not you owe the tax, and provide you with options

Our thorough analysis helps clarify your financial situation, giving you confidence in understanding any discrepancies and making informed decisions.

STEP 3: RESOLUTION

We handle the IRS, aiming for minimal cost and possibly zero tax paid.

We manage all IRS interactions, aiming to minimize your costs and stress. Our goal: the best outcome, possibly no taxes paid. Trust our experts to handle everything for you.

STEP 4: COMPLIANCE

We ensure accurate crypto filings and monitor transcripts to keep you ahead of the IRS.

We file your returns accurately, reflecting your crypto transactions. Our team routinely monitors your IRS transcripts, ensuring you stay compliant and avoid surprises.

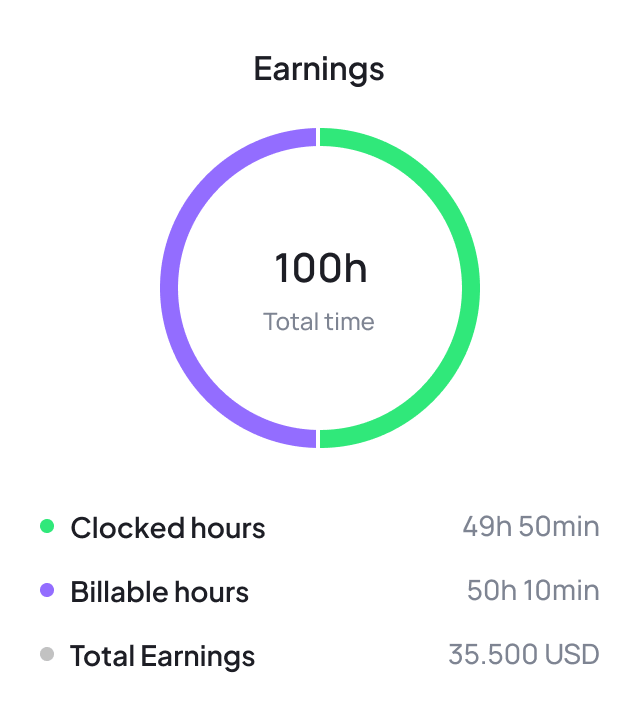

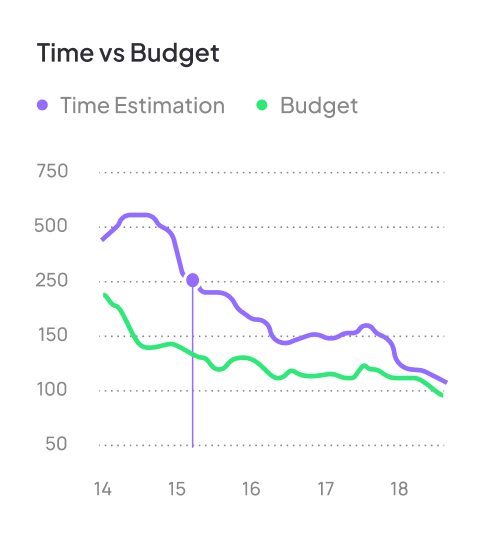

Real-time analytics

Check project progress and performance

Boost productivity, optimize workflows, and make data-driven decisions effortlessly.

-

Performance tracking

-

Resource optimization

-

Predictive analysis

Seamless workflows

Powerful and intuitive automation engine

Automate repetitive tasks, streamline processes, and enhance productivity with our powerful tools.

-

Workflow streamlining

-

Task prioritization

-

Notification system

Flexible pricing

Flexible pricing to suit every need

Enjoy a range of features designed to enhance your project management experience, all at a price that fits your budget.

Personal

- Task management, collaboration tools, and basic reporting

- Efficient organization and streamlined communication

- Users can manage up to 5 projects

Professional

- Advanced reporting, priority support, and customization options

- Better insights, tailored workflows, and enhanced collaboration

- Users can manage up to 15 projects

Enterprise

- Real-time analytics, a dedicated account manager, and API access

- Project management capabilities and strategic decision-making

- Users can manage unlimited projects

We are here for you.

Crypto Tax Resolution Services

We provide blockchain and DeFi reconciliation, obtain refunds for overpaid crypto taxes, establish IRS payment plans, and aggressively pursue penalty relief.

Blockchain and DeFi Reconciliation:

Ensure accurate records of your crypto transactions and wallet balances.

IRS Payment Plans:

Structure manageable payments to settle your crypto tax liabilities.

Offer in Compromise:

Negotiate to settle your crypto tax debts for less than the full amount owed.

Amended Tax Filings:

Correct errors in previous filings to reflect accurate crypto tax obligations.

Refunds for Overpaid Crypto Taxes:

Recover funds from overpayments. Never pay more than what you owe!

Penalty and Interest Relief:

Reduce or eliminate additional charges on your crypto tax debts.

Filing Back Taxes:

Bring your tax filings up-to-date with expert guidance on past crypto transactions.

Lien and Levy Issues:

Release liens and fight levies.

Latest News

Expert Insights & Updates

Discover essential insights, expert tips, and critical updates on crypto tax compliance and resolution.

Cost Basis is the Holy Grail

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Top 10 Options for Taxpayers w/ Massive IRS Debt

Tuesday’s primary is the first big test of the legislation, which was opposed by voting rights groups and Democrats. Struggling to sell one multi-million dollar

How to be Proactive when Crypto is Underreported or Returns are Not Filed

Tuesday’s primary is the first big test of the legislation, which was opposed by voting rights groups and Democrats. Struggling to sell one multi-million dollar

12,000+ Happy Clients

Success stories from our customers

The best way to showcase our commitment is through the experiences and stories of those who have partnered with us.

Frequently Asked Questions

Taxable events include selling crypto for fiat currency, trading one crypto for another, and using crypto to purchase goods or services. It's important to report these transactions accurately to the IRS.

It's recommended to amend your previous tax returns to include your crypto earnings. Our experts can guide you through the correction process to help you comply with IRS regulations.

Generally, you need to provide a complete history of your crypto transactions, including dates, amounts, and the involved parties. Maintaining detailed records can facilitate the tax filing process.

Yes, we can assist you in responding to IRS notifications and help you understand the steps needed to resolve any issues raised in these letters.

Failure to report can result in penalties and interest on the unpaid taxes. In severe cases, criminal charges such as tax evasion can be levied. It's always advisable to comply with IRS regulations to avoid penalties.

Yes, in certain circumstances the IRS offers debt forgiveness programs such as Offer in Compromise or temporary delays in collection. Our team can help you explore if you qualify for any debt forgiveness options.

Through proper legal channels and negotiating with the IRS, we can work to protect your assets while finding a resolution to your back tax problems. Stopping garnishment and liens as well.

We specialize in helping individuals who owe $50,000 or more in back taxes, including those arising from crypto transactions. Our team will work with you to find the best solution for your situation if you owe less than this amount.

Are you part of a firm?

Ask about our referral program

and white label services.

Increase your revenue, offer much needed services to your clients and benefit from our expertise.